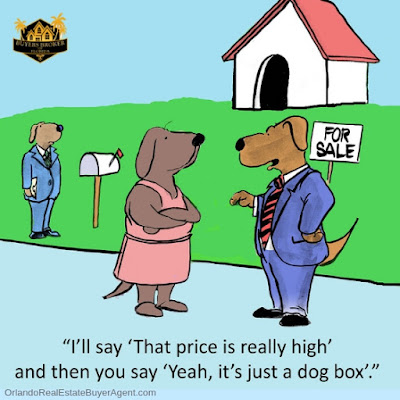

# 1 Know what the property is worth

Every property on the market has a value...yet most home buyers start making offers without knowing much about the property value. You should know that plus more...- Is the property fairly priced at market value?

- Is it priced low to generate multiple offers?

- Is it overpriced because inventory is short?

- Does the seller just want top dollar?

- Did the listing agent skew the seller on a higher value to get the listing?

- Did the agent price it too low in order to look good by selling it quickly?

Yes, for sure all those are possibles...and the negotiations will be different.

A good buyers agent should be able to answer those questions for you before you start writing offers. In fact, they should tell you what the surrounding properties sold for and what more than likely the property is worth. With that information, you become a better informed home buyer, so that you will be able to sort through your buying options easier.

Florida’s appraisal problems: Right now, the market in Central Florida is selling quickly due to a shortage of good inventory. The real estate market has rebounded faster here than in other cities which has created a problem with appraisals coming in “short”.

“Short appraisal” means the property is being sold for more than the lender's appraiser says it is valued at. For example; let's just say the property is under contract for $400K but the appraiser says it is only worth $375K. Unless the seller is willing to drop the price to $375K, you will need to pay an additional $25K (out of pocket) in order to close on this property. That does not necessarily mean the house is not worth it...that depends upon other factors like...what else is available in your criteria?

#2 What to offer on the home?

Depends upon a lot of variables. Your offer should take into consideration many things:

- Supply & demand of homes...

- Who is the seller?

- How many buyers are making offers?

- +How long has it been on the market?

- How much money do you have?

- Are you financing?

- How is this home priced?

- How badly do you want the property?

Is this the only home you are interested in? If so, you should relax your criteria so that you always have 1 or 2 backup properties. That way you will not feel pressured into paying more than you should, or more than you want to pay.

If this property is nice and well priced, more than likely there will be multiple offers on the home and it will sell close to full price or more. Sometimes you may offer over full price and still not get the property. Other buyers in your price range are viewing the same homes and will think this house is worth bidding on....just like you do. I know that paying full price does not feel good to most home buyers, but depending upon your budget and criteria, that may be your only option. Stay flexible.

Financing: If you are financing, you should be pre-approved for your loan. Pre-qualified (PQ) means nothing to most sellers, as you can go on the internet and create a fake PQ letter for yourself. Yes, some home buyers do that also…

If you are serious about actually getting a home, then you should submit your financing documents to a lender who can verify your purchasing power. That improves your home buying power to “pre-approved” status which raises your credibility above other buyers who are only pre-qualified and puts you into an “almost cash” bracket.

Yes, cash does talk. However, a low cash offer does not trump a high financed offer. Cash will only be preferred over offers at about the same price. If you are in a multiple offer situation, the seller may ask all the potential buyers for their “highest and best”...that is your final chance to raise your offer to better compete...or you can stay at your original offer. About 40% of buyers offers in Central Florida are “cash”.

My buyers typically ask me what they should offer and this is my advice: Regardless of which state or country you are from, making offers on homes in Florida is not the same as back home. Your offer can be Low, Medium, or High.

Here are the offer facts:

A LOW OFFER on a nice property will probably result in the seller not responding to you or giving a counter offer at full price. More than likely, the seller will be insulted and no longer willing to be reasonable or sell to you. The only time that a LOW OFFER works is if the property has been on the market too long, or needs major rehab work.

A MEDIUM OFFER offer will open the door for the seller to negotiate.

A HIGH OFFER is necessary when there are other offers on the table, or if you need to finance, or if you need seller paid closing costs.

If you are the only buyer bidding on the property and you have cash or solid financing, I like to suggest coming in reasonably low. Low enough to leave room for negotiations, yet not so insulting that your offer will be shut down. A good buyers agent will know the difference and be able to advise you.

# 3 Hire the right agent

Last but not least..this is the most important. Just like all people in the service business, brokers have certain skills and personalities. If you want to buy a good house, not overpay, and get everything that you contracted for, you cannot hire a “newbie” or simply someone related to someone at your place of work. You need someone qualified to help you that is savvy, experienced, and not afraid to speak up for you.

Differences of opinion and re-negotiations often come up in all transactions that the agent for the buyer should resolve in the buyers best interest. Many agents are afraid to speak up for the buyer or bring up issues that otherwise may not be noticed. Some brokers have no clue what to say or do...and when that happens, the buyer is really on their own.

Unfortunately, most buyer’s don’t realize it, until it is too late to change agents. I know that for a fact, because they call our office for help when it is too late. Right now, you are learning facts that will help you become a smart homebuyer, so keep reading...

There are many kinds of brokers/agents in Florida and they all have different duties and levels of experience. Statistics from the Orlando Regional Realtor association show that in Central Florida, 38% of realtors have been in business less than 1-year. Only 64% of realtors sold one or more homes last year. I believe that it takes years of experience and hundreds of transactions to be adequately “experienced” enough to do a great job for the buyer.

Here are some more surprising facts:

Florida has no mandatory agency disclosures. That means they are not required to tell you who they really work for. Their job may be to sell the property for the highest price and most favorable terms for the seller...but they do not have to tell you that. Florida is a buyer beware state.

99.9% of Florida realtors work as “transaction brokers” with no fiduciary duties to either party. That means no loyalty for you. No full confidentiality for you either. Even if a broker says they will represent you as a transaction broker, the definition does not allow them to advocate for you. They are simply facilitators.

Buyer agents who work in a listing office may have an obligation to push company listings on you. They may even be paid a higher commission if they sell you one of the company listings...and they do not need to disclose that, so you will never know.

Exclusive Buyer Agents work in an office that never represents sellers. They have no conflict of interest as they only represent only the best interest of the home buyer with 100% loyalty, 100% confidentiality, 100% full disclosure.

Florida has about 300,000 licensed brokers to choose from. Less than 40 brokers represent only the home buyers as Exclusive Buyer Brokers. It is a rare niche because it takes a high level of confidence and competence to give up sellers and build a business representing only home buyers. Having an exclusive buyer agent on your side is priceless and at no added cost.

Call us for straight answers to all your questions 407-539-1053 and thank you for discovering the 3 Tips for negotiating a Florida Home.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.